The housing market in Calgary continues to adjust to various shocks, including the fastest rise in interest rates in Canadian history, inflation, and supply chain disruptions. This has left many Calgarians feeling unsure about where things are headed into 2023.

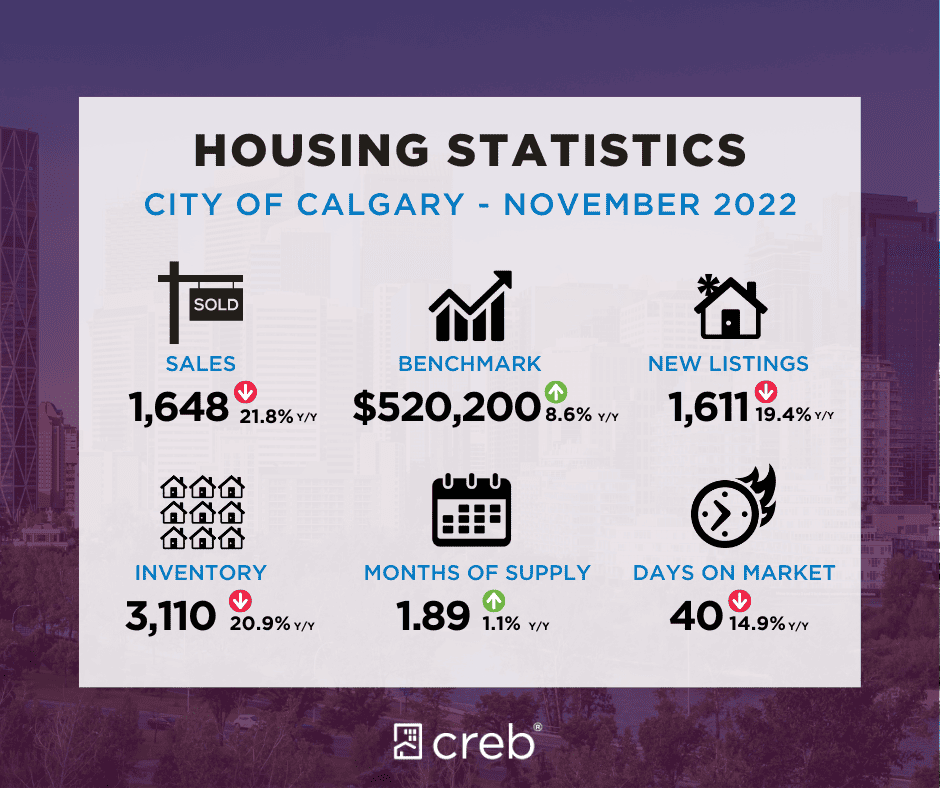

For the month end of Nov 2022, Residential sales in the city slowed to 1,648 units, a year-over-year decline of 22 per cent, but 12 per cent above the 10-year average.

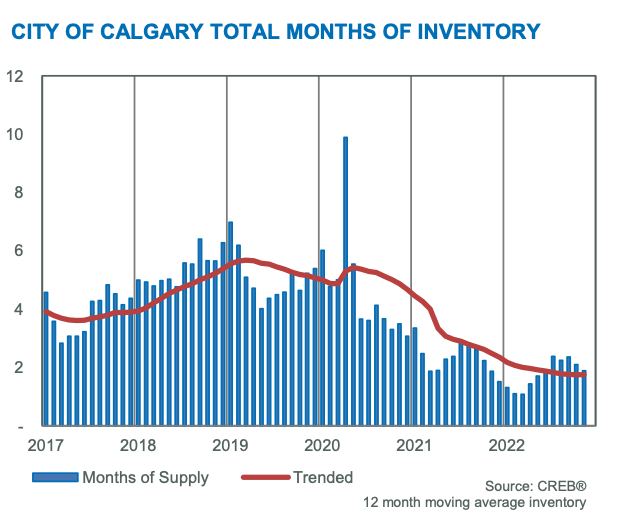

A decline in sales was met with a pullback in new listings and inventories fell to the lowest level reported in November since 2005. The pullback in both sales and new listings kept the months of supply relatively tight at below two months. The tightest conditions are occurring in the lower-price ranges as supply growth has mostly been driven by gains in the upper-end of the market.

Despite the lower supply levels, prices have trended down from the peak reached in May of this year. Even with the adjustments that have occurred, November benchmark prices continue to remain nearly nine per cent higher than levels reported last year.

The pullback in sales over the past six months was not enough to erase gains from earlier in the year as year-to-date sales remain nearly 10 per cent above last year’s record high. The year-to-date sales growth has been driven by a surge in both apartment condominium and row sales.

“Easing sales have been driven mostly by declines in the detached sector of the market,” said CREB® Chief Economist Ann-Marie Lurie. “Higher lending rates are impacting purchasers buying power and limited supply choice in the lower price ranges of the detached market is likely causing many purchasers to place buying decisions on hold.”

Detached Homes

Detached sales slowed across every price range this month, contributing to the year-over-year decline of nearly 34 per cent and the year-to-date decline of five per cent. On a year-to-date basis, sales have eased for homes priced under $500,000 as the level of new listings in this price range has dropped by over 36 per cent limiting the options for purchasers looking for affordable product.

Meanwhile, new listings and supply selection did improve for higher-priced properties creating more balanced conditions in the upper-end of the market. This has different implications on price pressure in the market.

The benchmark price in November slowed to $619,700, down from the high in May of $648,500. While prices have eased over the past several months, they continue to remain nearly 11 per cent higher than levels reported last year.

Semi-Detached Homes

The pullback in sales this month was enough to cause the year-to-date sales to ease by nearly one per cent compared to last year. Despite the recent declines, year-to-date sales remain 37 per cent above long-term averages for the city.

Easing sales this month were also met with a pullback in new listings, causing further declines in inventory levels and ensuring market conditions remained relatively tight with a month of supply of two months and a sales-to-new-listings ratio of 100 per cent.

Unlike the detached sector, the tight conditions prevented any further retraction in prices this month. In November, the benchmark price reached $562,800, slightly higher than last month and nearly 10 per cent higher than last year’s levels.

Row Homes

Further declines in new listings likely contributed to the slower sales activity this month as the sales-to-new-listings ratio remained high at 99 per cent. Inventory levels fell to 383 units, making it the lowest level of November inventory recorded since the 2013. This low level of inventory ensured that the months of supply remained below two months.

Despite the persistently tight market conditions, prices trended down this month reaching $358,700. While prices have eased from the June high, they are nearly 14 per cent higher than prices reported last November. The strongest price growth was reported in the North East, North and South East districts where prices have risen by over 18 per cent.

Apartments

Despite a pullback in new listings this month, apartment condominium sales continued to rise, and inventories fell to the lowest November levels seen since 2013. This caused further tightening in market conditions as the sales-to-new-listings ratio pushed above 100 per cent and a months of supply dropped to two months.

Recent tightening in the market has put a pause on price adjustments for apartment condominiums. In November, prices remained relatively stable at $277,000 compared to last month. While prices have reported a year-over-year gain of nearly 10 per cent, prices are still below their previous highs set back in 2014.

Erick's Perspective; What Might Lay Ahead in 2023

Buyers and Sellers should continue to be mindful that nearly all the price appreciation experienced in 2021-2022 was due economic shocks. Primarily;

- Record low interest rates (due to Covid 19)

- Interprovincial migration(due to inflation shock)

- Supply disruptions in building materials

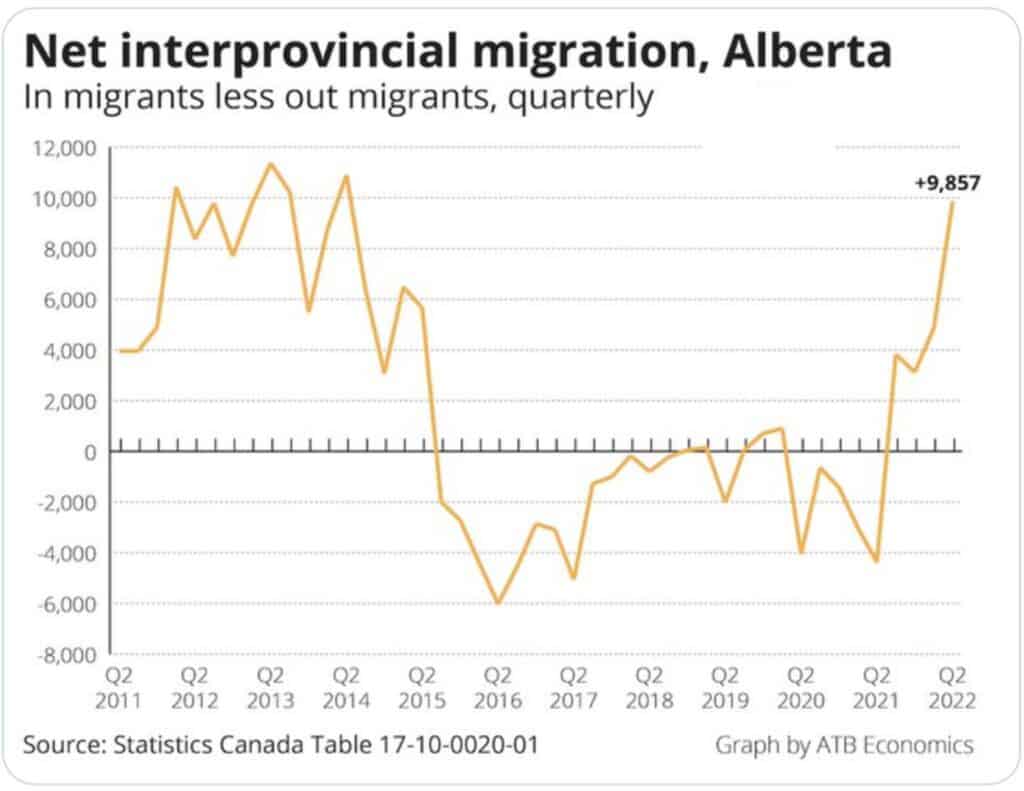

Effectively what we have seen is extremely low interest rates in 2020-21 create record extreme homes prices specifically in British Columbia and Ontario, placing detached homes outside of reach of thousands of young Canadians. Calgary’s affordable housing market and Alberta’s strong jobs market created a perfect storm for a surge in young interprovincial migration.

These external factors combined with record inflation (due to government policy) and building supply disruptions (due to Covid-19) created difficult conditions for Calgary’s home builders. Essentially, home builders were not able to keep up with the demand surge and this spilled into the resale market which was already in tight supply.

Fast forward to Dec 2022, and we have a completely different landscape. Now the housing market is adjusting to the fastest rise in interest rates in Canadian history as the bank of Canada attempts to control inflation (which it helped create)

So where does this leave us for 2023 and beyond?

Interest Rates

We no longer have low interest rates to drive the market higher. The sudden rise in rates has removed between $30,000-$100,000 in purchasing power from buyers.

A family with a combined income of $150,000 applying for a 6% mortgage will be approved for about $90,000 less than at 1.5% (back in 2020). They must then either not purchase (which removes buyers) or offer a seller less money based on what they can afford (which lowers prices).

Overall the rise in interest rates will serve as a strong headwind for real estate prices in Calgary, unless other factors can offset the change.

Interprovincial Migration

This is perhaps the greatest wild card in 2023. There still exists a significant price disparity between major cities in British Columbia, Ontario and Alberta. In fact, it is about $500,000! This could created a consistent flow of buyers into Alberta’s market, that could possibly, offset the sudden rise in interest rates.

Average home values:

- Vancouver; $1,148,900

- Toronto; $1,098,200

- Calgary; $619,700

The trend of young families living in smaller apartments/townhomes, unable to afford a larger detached home in BC and Ontario looks to continue well into 2023.

Moreover, inflation will only accelerate the trend as young families in expensive cities will come under more pressure. Selling a 1000sqft townhome in Vancouver for $700,000 and buying a 2000+ sqft detached home in Calgary for $500,000 seems like a great option. If out of province buyers can import their home equity into Alberta, this could be very supportive for home prices, more so than many economist currently predict.

I do not see Alberta’s interprovincial migration slowing just yet. Unless, however, BC and Ontario enter into a sever market correction making it difficult for sellers to cash out of their local market.

Inflation

We have heard so much about it. However, it is widely misunderstood. As the acclaimed ecomomist Milton Friedman once said inflation is ‘always and everywhere a monetary phenomenon’. What this means is that governments create inflation by printing excess money. As much as they attempt to blame someone else.

Have you seen governments stop spending? In fact, it’s the opposite they are printing more money and handing it out to the public as inflation relief. This will only serve to entrench inflation permanently in the economy as it begins to make its way into wages. Once this occurs you will begin to see it become entrenched in the housing market. There is positive correlation between wages and home prices, after all that’s how mortgages get calculated.

There may be sudden drops of headline CPI inflation in 2023-24, however the products and services that most people rely on will remain historically expensive. Things like food, energy, and rent will not materially adjust lower-.

I do not see inflation returning to 2% on a steady basis, in fact it will likely bounce between 4%-15% over the next decade. Overall, this will support real estate prices, as building material will become very expensive.

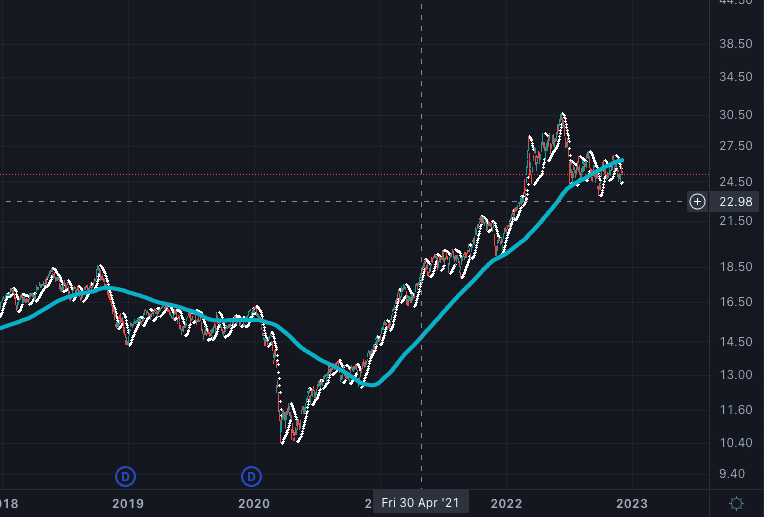

Commodity Pricing

Commodity prices have seen rapid rise since the Covid 19 low, and the bull trend is yet to reverse. Chronic under investment for decades has caused a rapid depletion of major world commodities, this coupled with the Russia-Ukraine war has only made the problem worse.

Even if global demand remains stable or weakens, there is not enough current supply of essential commodities to meet demand. If demand increases, then we can expect an even sharper rise in commodity prices, this in turn, will only fuel inflation further.

In general, a healthy commodities market has been positive for Calgary real estate. I would watch out for a spike in prices sometime in 2023, and this would add further fuel to Calgary’s already tight labour market.

Housing Shortage

Taking all the points above in consideration, it is important to then understand how many houses are actually available for purchase.

The fact is, that since the sudden inventory spike of Feb 20th 2020, Calgary’s housing inventory has collapsed. We have witnessed a 80%+ fall in available inventory. With available inventory remaining sticky at only 2-3 months, it will be near impossible to see Calgary’s real estate prices fall significantly. Of course, if an economic shock where to occur like in 2020, we would see a temporary spike in inventory.

In general, the major economic forces point to pressure on Calgary’s housing inventory. Local homeowners will be reluctant to leave an affordable city, they will also be reluctant to upgrade within the city due to higher lending costs. This will keep Calgarians from listing their home for sale at the historical rate. Builders will find it increasingly difficult to source affordable materials and labour, both of which are in short supply. This will keep the new home inventory in short supply.

See What We Can Do For You

*Based on 2022 sales performance for Holly & Erick Home Team. Commission savings based on 2% vs 7%/3% fee structure for Calgary & area market.